Shopping for bad credit car loans was an educational experience, and some of the interest rates and fees were “eye-watering”.

In this article, I’ll share the details of my visit with each car dealer, crunch the numbers, and then give you my overall takeaways.

But first, let’s set the scene.

For my “mystery shop”, I followed the same script with every car dealer I visited.

I walked in the front door and spoke with the first salesperson I saw. I then told them that I was doing some preliminary car shopping for my daughter, who desperately needed a car but had horrible credit.

By “horrible,” I mean a credit score below 500, the result of unpaid credit cards and a cell phone bill that had been sent to collections but had since been cleared up.

But it wasn’t all bad; my kid had been working at the same full-time job for “at least a year," and was doing her best to clean things up.

Dealership #1

I arrived at my first dealership, Ride Time, just after 9 AM, with my Tim Horton’s medium dark roast in hand. According to the company website, they’ve been “in the business of approving people with bad or no credit since 2007.”

As soon as I entered the front door, a salesperson seated at a desk gave me a friendly smile and waved me over to her desk. I walked over and sat down.

I told her about my situation, car shopping for my 20–year–old kid with bad credit, and asked about her chances of approval and what interest rate they could expect. After asking some extra questions regarding employment history and credit score details, I was told that the interest rate could range from 13.5% to 24% (as a ballpark figure).

Of course, this would depend on the severity of the credit, the bank lending the money, the down payment amount, and other factors.

The salesperson mentioned that if I was willing to “cosign”, then she could probably get the rate somewhere between 6% to 7.99%. Again, ballpark.

But here’s the rub. I wouldn’t actually be cosigning for the loan. According to the salesperson, I would be the primary applicant, and my child the coapplicant. In other words, it would be my loan, not my daughters.

According to the salesperson, it was a workaround to get the best possible rate.

I told her I didn’t want my name on the loan. In that case, she strongly recommended that my child get pre-approved for financing upfront, which only makes sense.

Other noteworthy details. It was highly encouraged that my daughter come up with a down payment. The more the better, but even $500 could make a difference when it comes to approval.

On to Dealership #2!

Armed with my information from Ride Time, I hopped back in my car and headed down the street to the following “bad credit” used car dealer, Match Auto Market. Match believes that “everyone deserves a chance to drive the vehicle they want, regardless of their credit history.”

The salesperson I spoke to at Match was very friendly and quickly let me know that they offer financing through several banks and alternative lenders. However, for bad credit loans, interest rates could be as high as 29.99%! Ouch!! And I thought credit card interest rates were high.

Of course, that was a worst-case scenario. He said the average interest rate for someone with average to good credit would be closer to 8.99%, a big difference. He assured me that even if my daughter were faced with a rate closer to 30%, it was open-ended. That means she could pay it off without any penalties. All of the used car dealers I visited told me the same thing.

Not sure that offered much comfort, but it was good to know.

The salesperson at Match did provide one piece of advice that surprised me. He said that it was better for people with bad credit to purchase a newer (aka more expensive) vehicle, because the chances of approval were higher. I asked him what he meant by “newer”, and he said 2018-2020. You can buy a 2013 or 2014 car, but apparently, banks don’t want to finance cheaper, older cars.

It wasn’t the last time I would hear this on my tour of bad credit car dealerships.

Dealership #3

From Match Auto Market, I drove down the road to Midland AutoSave. Compared to the first two dealerships, Midland appeared to be a much smaller operation, with no showroom that I could see.

The one salesperson in the office was, you guessed it, very friendly.

He let me know right away that they did not offer in-house financing and that they only dealt with third-party lenders. He also made it clear that my daughter would need a cosigner.

If it was optional, he wasn’t letting on.

Like Match Auto Market, Midland quoted me rates as high as 29.99%. The salesperson also informed me that my daughter would need a down payment of at least 15% to 20% to increase her chances of approval.

That’s as much as $4,000 on a $20,000 car!

I get it, but it’s not realistic for many people, let alone those who are staring down 30% car loans.

I then asked him about fees. He said that the dealer doesn’t charge any fees, but the bank lending the money could charge a financing fee of $500 or more. It varies, depending on the situation.

I thanked the salesperson for his time and set out for my next dealer.

Dealership #4…this is where it gets interesting!

My next stop was Birchwood Credit. A division of Birchwood Automotive, one of Manitoba’s largest car dealership networks, Birchwood Credit specializes in selling cars to buyers with “less than perfect credit.”

Birchwood differed from the first three dealers I visited because, in addition to bank financing, they offered in-house funding. While that’s not uncommon for a large car dealership, I was surprised to find out that the in-house interest rates were lower than those offered by banks (to people with the worst credit.)

According to the salesperson, in-house rates maxed out at around 14% - 15%, while the banks could be as high as 29.99%

(29%, sound familiar?) However, for clients with good credit, banks offered the lowest rates (7% to 9% vs. 10% or more for in-house loans).

What also surprised me (pleasantly) at Birchwood was that the salesperson seemed genuinely interested in helping customers rebuild their credit. He mentioned it several times.

I asked him if there was a minimum credit score requirement. He told me that Birchwood doesn’t base its lending criteria solely on the credit score.' He said it was “situational,” and that they focused more on employment history and income (aka, can you afford the monthly payments?).

Monthly payments...more on that later.

A Red Flag?

I did pick up a couple of red flags that could make a high-interest loan even more costly. The salesperson informed me that gap insurance is typically required for loans with bad credit. While this can protect both the lender and the car buyer, it is an added cost and could make your loan more expensive.

Also, Birchwood includes a feature called “Tire, Rim, and Towing Protection” on all bad credit car loans. I asked if this was mandatory. The sales guy wouldn’t confirm; he just said they have it on all their loans.

I got the impression that it would be very difficult to opt out of this coverage. While these protections could be beneficial, they’re another expense on an already costly loan.

Dealership #5

I drove to the east end of Winnipeg to visit my last bad credit car dealer. It might be the Granddaddy of them all; a quick Google search for Autolist Canada brings up the title, “THE ORIGINAL Bad Credit, No Credit Used Car Dealership in Winnipeg, MB.”

And the salesperson didn’t disappoint. As soon as I told him the situation (daughter has a horrible credit score and needs a car), he told me that he could “100% guarantee approval!” Wow! I was impressed. : )

Like Birchwood, Autolist Canada offers in-house and bank financing options. I asked him about interest rates, and he would only give me a broad range (11% to, you guessed it, 29.99%!) He said he would try to get the loan approved with the banks first, but if all else failed, the dealership would provide the funding for the loan in-house.

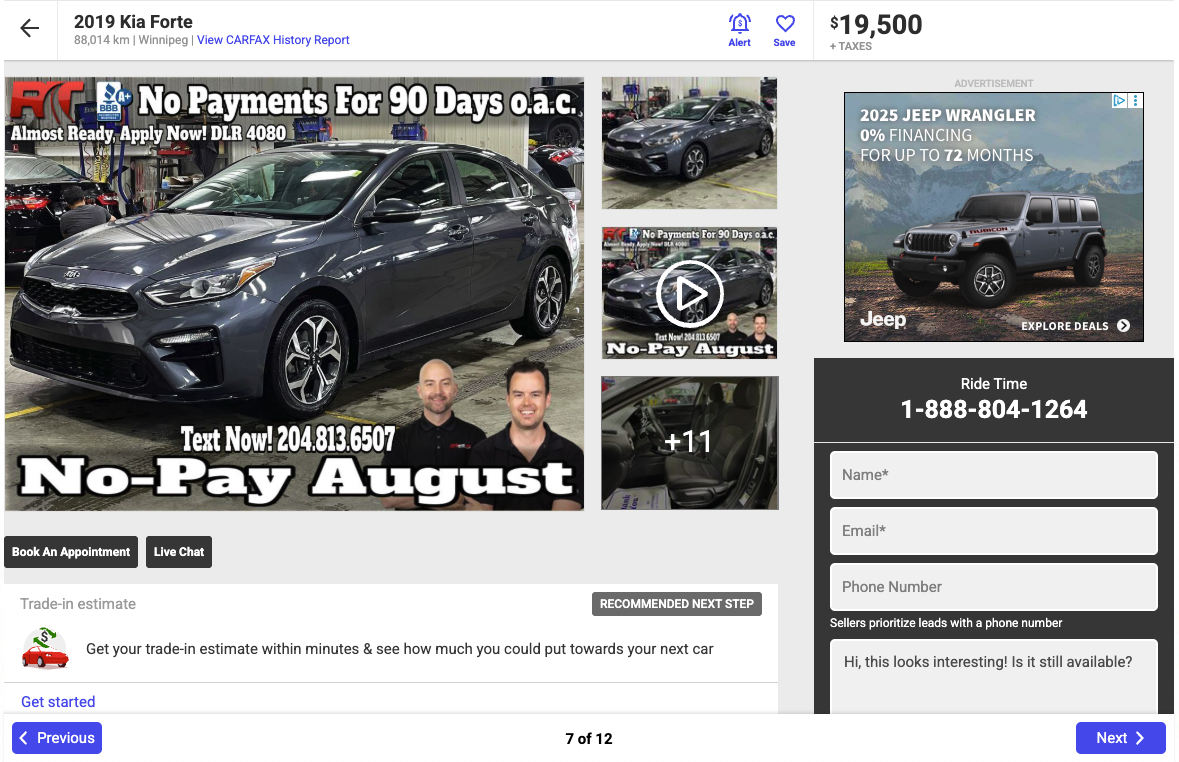

As with most other dealers, he told me that when it came to buying a car, the sweet spot for individuals with bad credit was a newer used car, such as a Kia Forte or a Hyundai Elantra, ideally from the 2018 to 2020 model years. He even gave me an ideal purchase price of $19,000 - $23,000.

Let me tell you, bad credit car dealers love their Kias and Hyundais. He also told me that banks don’t want to lend money on older cars (e.g., 10 years or older), and that the loan terms (the number of months it takes to pay off the loan) could be extended over a much longer period for newer cars, which might result in a more favourable monthly payment.

So, What Did I Learn?

After leaving the fifth and final dealership, I headed home to crunch the numbers and try to make sense of everything I’d learned. Here are my key takeaways:

The True Cost of a 30% Car Loan

Several of the dealers I spoke with quoted 29.99% as the highest possible interest rate a client with bad credit would pay. One salesperson told me this was because it’s the highest legal limit, though, according to the Canadian Criminal Code, it's slightly higher, at 35% APR.

Either way, 29.99% is WAY TOO MUCH for anyone to be paying on a car loan!

I should point out that while some dealers quoted potential rates ranging from 6% to 11%, they would not be offered to a car buyer with a 500 credit score, but could be available to buyers with very good to excellent credit.

To give you an idea of how expensive it would be to finance a car at almost 30% interest, I found a 2019 Kia Forte that’s currently listed for sale at the first dealership I visited, Ride Time:

Remember, according to several dealers I spoke with, this was the “sweet spot” vehicle for car buyers with bad credit!

Next, in the table below, I’ve calculated the ACTUAL COST of financing this vehicle using three different interest rates: 7%, 15%, and 29.99%. According to the salespeople I spoke with, the 7% rate would be close to what someone with good credit might get, the 15% would be for someone with not-so-great credit, and the 29.99% would be a worst-case scenario for someone with terrible credit.

I’m assuming a down payment of $1,000 and a loan term of 60 months (5 years), but I’m not including ANY additional fees (remember, there will usually be extra fees). Also, I’m including sales taxes of 12% (5% GST + 7% PST, the current rate in Manitoba). Remember that PST rates vary by province.

Estimated Cost of Financing a 2019 Kia Forte at 3 Different Interest Rates

Should You Ever Say Yes to a 30% Loan?

In the above example, if you agreed to finance a car at an interest rate of 29.99%, you would end up paying around $40,450 for a $19,500 car. A vehicle that will likely only be worth about $7,000 by the time you pay off the loan!

To make matters worse, you would be stuck making monthly payments of almost $700 for five years!

About those monthly payments…

Whether you’re buying a new or used car, most car dealerships try to get you to focus on the monthly payment instead of the actual cost of the loan. But that can be deceiving, because the monthly payment is a poor indicator of the total cost of the vehicle.

Car dealers and banks can stretch car loan payments over longer periods, up to 84 months, to make the car loan seem more affordable, while the costs are astronomical.

So, should you ever agree to a 30% car loan?

All I can say is that if I had a 20-year-old daughter with a horrible credit score in need of a car, I would do everything in my power to help her find a more affordable solution. Not everyone can get a cosigner with good credit. Still, it might mean waiting until you have a larger down payment, shopping around for a lower rate, or borrowing a vehicle from a friend or family member temporarily.